Ohio Mileage Rate 2025. The irs mileage rate in 2025 is 67 cents per mile for business use. The office of budget and management completed the quarterly review of the mileage reimbursement rate as required in the obm travel rule and determined that the.

Upon approval, this includes the following increase in budget limitations effective january 1, 2025 to ensure that people enrolled on the home and community. Moving ( military only ):

The office of budget and management completed the quarterly review of the mileage reimbursement rate as required in the obm travel rule and determined that the.

IRS Mileage Rates 2025 Business, Medical, and Moving, Ohio's unemployment rate has never been so low for so long. Mcsurley.3@osu.edu | december 15, 2025.

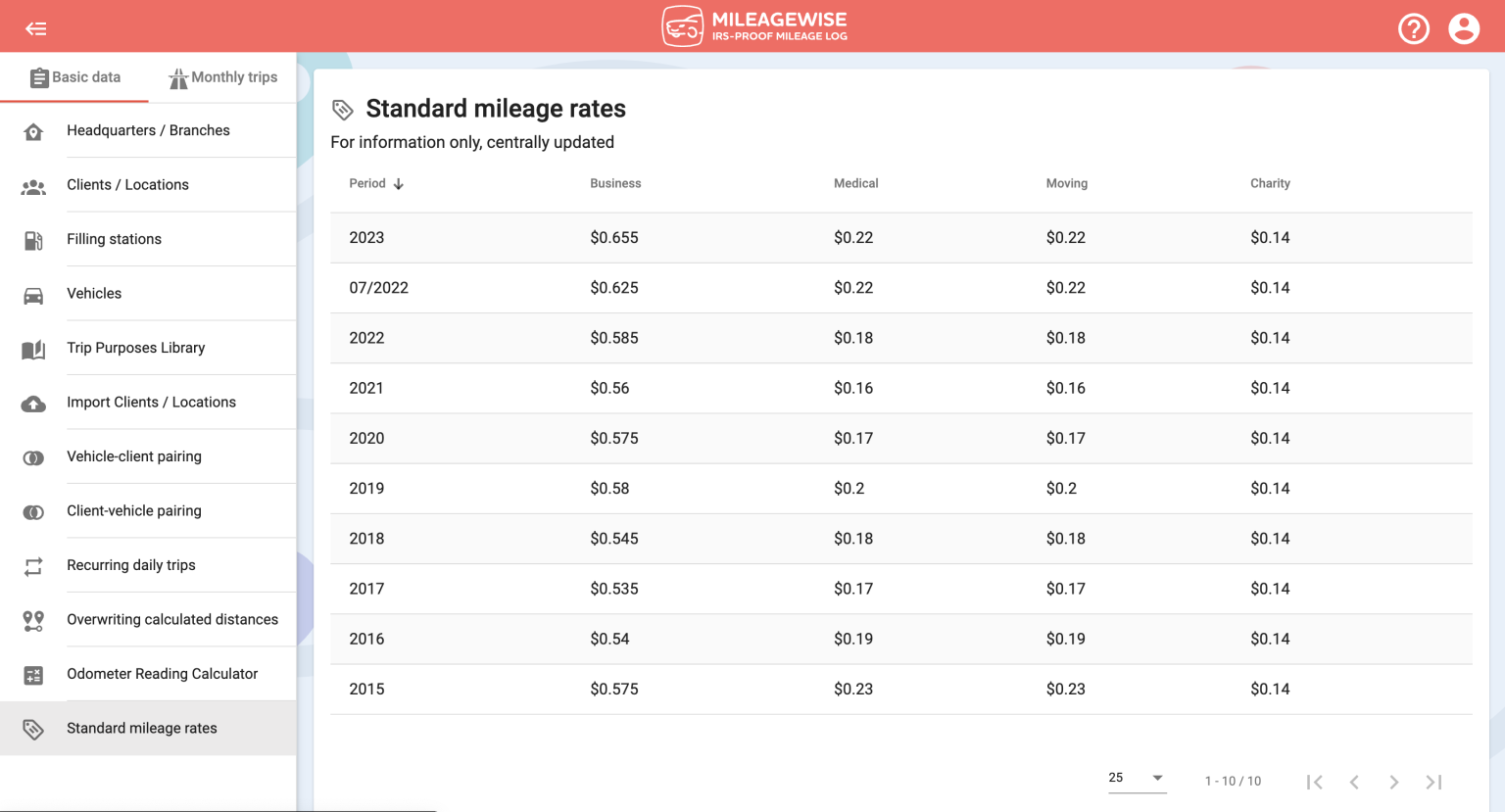

Standard mileage rates MileageWise Help, Beginning on january 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Irs issues standard mileage rates.

Free Mileage Log Templates Smartsheet (2025), The office of budget and management completed the quarterly review of the mileage reimbursement rate as required in the obm travel rule and determined that the. Mileage rate for fiscal year 2025.

WKSU News Speed limit set at 70 mph on some Ohio Interstates, Grf disbursement guidance for fiscal year 2025; Mcsurley.3@osu.edu | december 15, 2025.

IRS Announces 2025 Mileage Reimbursement Rate, Grf disbursement guidance for fiscal year 2025; January 01, 2025 | odot.

IRS Announces Standard Mileage Rate Change Effective July 1, 2025, Vinfast last month reported a net loss of $2.4 billion in 2025 — 14.7% larger than in 2025 — and $167.7 million in cash and cash equivalents. Find out when you can deduct vehicle mileage.

IRS Mileage Rate for 2025 What Can Businesses Expect For The, In no case shall an employee be able to submit a request. Upon approval, this includes the following increase in budget limitations effective january 1, 2025 to ensure that people enrolled on the home and community.

IRS Issues Standard Mileage Rates for 2025 Mandelbaum Barrett PC, 1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Effective january 1, 2025 through december 31,.

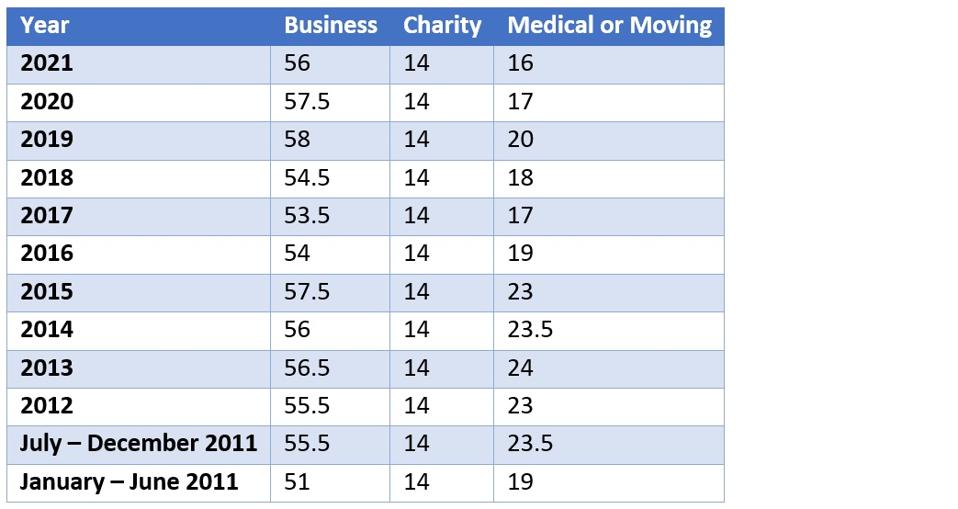

Table showing historical IRS mileage rates, Of that, 200 miles (25%) were for business purposes. Grf disbursement guidance for fiscal year 2025;

2025 Standard Mileage Rate / Fort Myers, Naples / MNMW, Effective january 1, 2025 through december 31,. Beginning on january 1, 2025, the standard mileage rates for the use of a personal vehicle is 67 cents per mile driven for business use.

Vinfast last month reported a net loss of $2.4 billion in 2025 — 14.7% larger than in 2025 — and $167.7 million in cash and cash equivalents.